Market Dynamics - Rising Interest Rates

We are in the midst of the most rapid increase in the Federal Funds Rate in forty years. Institutional capital is remaining on the sidelines. Housing supply is constricted. What am I supposed to do?

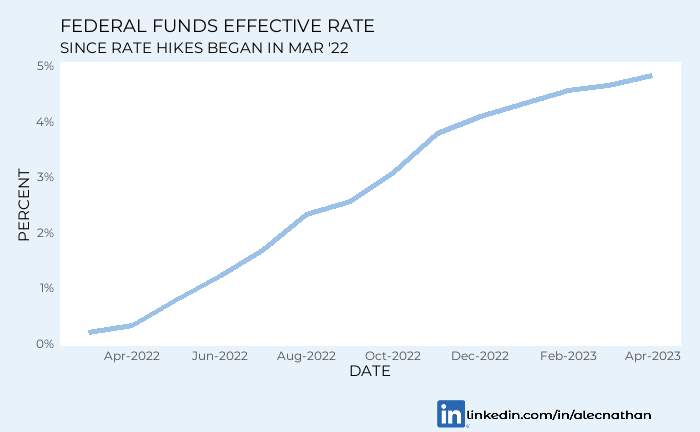

In a mere 14 months the federal funds effective rate is up 480 BPS1. This meteoric ascent of the cost of capital, in conjunction with uncertainty fueled by recent bank failures, has retail and institutional investors on uncertain footing.

The rate hikes have been fueled by inflation and a hot labor market. However naysayers are worried that fed-induced headwinds are harmful to capital intensive industries and leave financial institutions exposed to undue risk.

Everyone has their take. The op-eds will opine and the pundits will posit. What does this mean for me?

In short, this makes it a lot harder for me to afford a home. As I have mentioned previously, I’d love to buy a home in Atlanta in the near future. Each and every basis point limits my purchasing power. Is this good on a macro level? Possibly. Maybe the home I would acquire with essentially free money would overextend me and increase systemic risk.

But, possibly not. With housing supply constricted, homeownership, the easiest way to build wealth, has been restricted to those who have already built wealth. In a stark reversal of a recent trend, baby boomers are now buying more homes than millenials2. In addition, only 26% of purchasers in 2022 were first-time homebuyers. Those acquiring subsequent homes are inherently more liquid. They have built equity in their first (or second, third, etc.) homes and can put sales proceeds towards a new residence. Flush pockets decrease a consumer’s sensitivity to interest rates.

Is there anything wrong with older Americans buying a home? In my opinion, no. However, it is clear that they have a leg up in the competition for scarce housing supply.

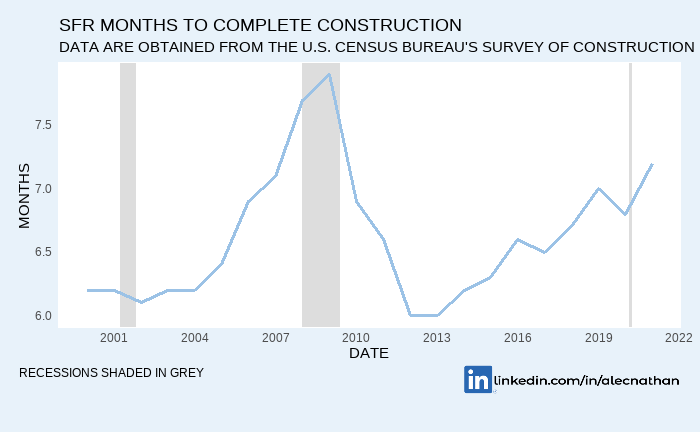

Rising rates compound (ha, interest pun) this issue yet again. As I’ve discussed in the past, building new housing stock is capital intensive. If the spreads between the risk free rate and the returns on home development are not sufficient, builders are likely to slow down. This has been observed in the Census Bureau’s Survey of Construction.

Limited new housing stock will cause supply issues to persist and reinforce the demographic flip in homebuyer trends.

What is the road back from this topsy-turvy environment? For one, rather than subsidizing risky borrowers, we should incentivize developers to bring more single family residences to market. This would help to solve the supply issue, support capital-intensive industry, and stabilize home prices. Selfishly, this would also help me to buy a home.

This article represents the views of the author and only the author. This piece is not meant to reflect the opinions of the author’s employer.

Alec A. Nathan is the Director of Research and Data Analytics at Sylvan Road Capital. A graduate of the University of Georgia, Alec specializes in real estate investment and data science. Please direct any inquiries to anathan@sylvanroad.com.

Source: The Federal Reserve via the Wall Street Journal